All Categories

Featured

Table of Contents

The disadvantages of limitless banking are typically neglected or otherwise discussed in any way (much of the information offered concerning this idea is from insurance coverage representatives, which might be a little biased). Only the cash worth is expanding at the dividend rate. You likewise have to pay for the expense of insurance, costs, and expenditures.

Business that supply non-direct recognition car loans may have a lower returns rate. Your money is secured right into a complicated insurance policy item, and abandonment fees typically do not vanish until you've had the policy for 10 to 15 years. Every permanent life insurance policy plan is various, yet it's clear someone's total return on every buck spent on an insurance policy item might not be anywhere near to the returns price for the plan.

Infinite Banking Course

To give an extremely basic and hypothetical instance, allow's assume a person has the ability to earn 3%, generally, for each buck they spend on an "limitless banking" insurance product (after all costs and charges). This is double the approximated return of entire life insurance from Customer Information of 1.5%. If we assume those bucks would be subject to 50% in taxes complete otherwise in the insurance product, the tax-adjusted price of return can be 4.5%.

We presume greater than average returns on the whole life item and an extremely high tax price on dollars not take into the plan (that makes the insurance item look far better). The reality for lots of folks may be even worse. This fades in contrast to the long-lasting return of the S&P 500 of over 10%.

Infinite banking is a fantastic product for representatives that offer insurance policy, but may not be optimal when compared to the less expensive alternatives (with no sales individuals making fat commissions). Here's a breakdown of several of the other supposed advantages of unlimited financial and why they might not be all they're gone crazy to be.

Infinite Life Insurance

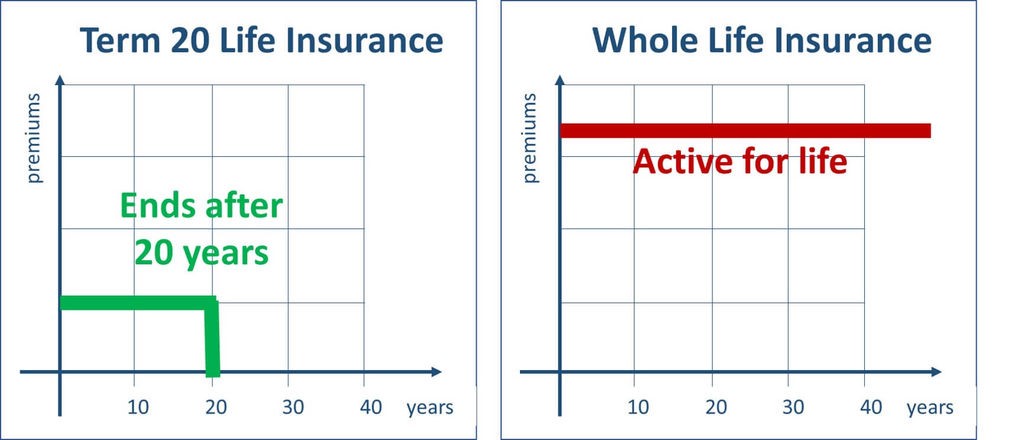

At the end of the day you are getting an insurance policy product. We love the security that insurance coverage supplies, which can be acquired much less expensively from a low-priced term life insurance policy policy. Unpaid fundings from the policy may additionally lower your death advantage, lessening an additional degree of protection in the policy.

The principle just functions when you not only pay the considerable premiums, however use added cash to buy paid-up additions. The opportunity cost of all of those dollars is incredible exceptionally so when you can instead be purchasing a Roth Individual Retirement Account, HSA, or 401(k). Even when contrasted to a taxable financial investment account or even a savings account, boundless banking may not offer comparable returns (compared to investing) and comparable liquidity, accessibility, and low/no charge structure (contrasted to a high-yield interest-bearing accounts).

With the rise of TikTok as an information-sharing system, monetary suggestions and methods have found a novel method of spreading. One such approach that has actually been making the rounds is the boundless banking idea, or IBC for short, garnering recommendations from celebs like rapper Waka Flocka Fire. Nevertheless, while the method is currently popular, its origins trace back to the 1980s when economic expert Nelson Nash presented it to the globe.

Within these plans, the cash money worth expands based on a price set by the insurance provider. When a substantial cash money value accumulates, insurance policy holders can get a cash money value funding. These financings vary from conventional ones, with life insurance policy working as collateral, suggesting one might shed their coverage if loaning excessively without ample cash money worth to support the insurance policy expenses.

My Wallet Be Your Own Bank

And while the appeal of these policies is apparent, there are natural limitations and dangers, necessitating diligent cash money worth tracking. The strategy's legitimacy isn't black and white. For high-net-worth people or company owner, specifically those making use of approaches like company-owned life insurance (COLI), the benefits of tax breaks and substance development could be appealing.

The attraction of infinite financial doesn't negate its challenges: Price: The foundational need, an irreversible life insurance policy, is more expensive than its term equivalents. Eligibility: Not everyone gets entire life insurance coverage due to extensive underwriting processes that can omit those with specific health or lifestyle conditions. Intricacy and danger: The elaborate nature of IBC, paired with its risks, might prevent several, especially when less complex and less risky choices are available.

Assigning around 10% of your regular monthly revenue to the plan is just not viable for many individuals. Part of what you read below is merely a reiteration of what has currently been claimed over.

Prior to you get on your own right into a scenario you're not prepared for, recognize the adhering to first: Although the idea is typically offered as such, you're not actually taking a funding from yourself. If that held true, you wouldn't have to settle it. Rather, you're borrowing from the insurance coverage company and have to settle it with interest

Infinite Banking Forum

Some social media blog posts advise making use of money worth from whole life insurance policy to pay down charge card financial debt. The concept is that when you settle the car loan with interest, the quantity will certainly be sent back to your investments. However, that's not just how it functions. When you pay back the funding, a part of that passion mosts likely to the insurance provider.

For the very first a number of years, you'll be paying off the compensation. This makes it very challenging for your plan to build up value throughout this time. Unless you can pay for to pay a few to a number of hundred bucks for the next years or even more, IBC will not work for you.

If you call for life insurance, here are some valuable ideas to take into consideration: Take into consideration term life insurance policy. Make sure to shop around for the finest price.

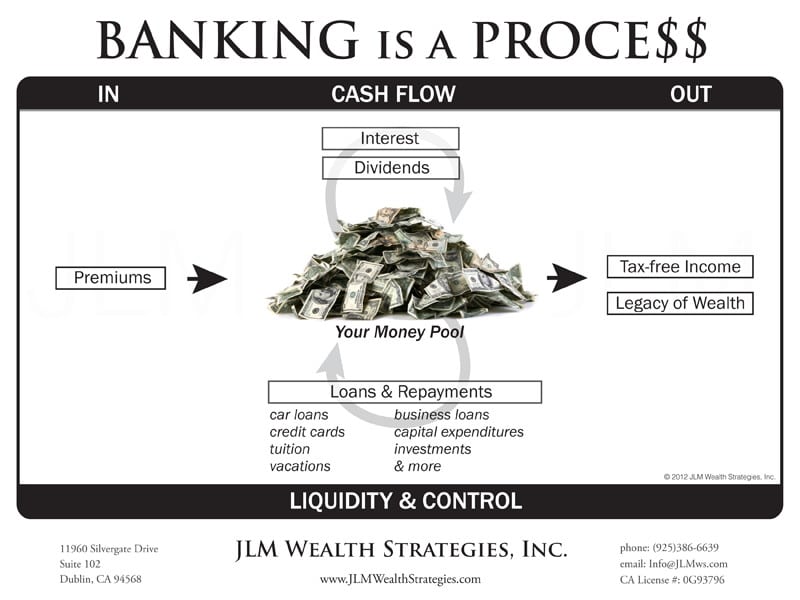

Boundless banking is not a service or product supplied by a particular organization. Limitless financial is a method in which you purchase a life insurance policy policy that collects interest-earning cash value and obtain fundings against it, "obtaining from yourself" as a resource of resources. Then ultimately pay back the finance and begin the cycle all over again.

Pay policy costs, a section of which develops money value. Cash money value gains compounding interest. Take a finance out against the plan's cash money worth, tax-free. Repay financings with rate of interest. Money value builds up again, and the cycle repeats. If you use this concept as meant, you're taking money out of your life insurance policy plan to acquire every little thing you 'd need for the rest of your life.

Table of Contents

Latest Posts

Banking Concept

Becoming Your Own Bank

Ibc Be Your Own Bank

More

Latest Posts

Banking Concept

Becoming Your Own Bank

Ibc Be Your Own Bank