All Categories

Featured

Table of Contents

[/video]

You can't take a loan out on yourself, if there's no money to take a loan from. Make feeling? Now the interesting thing is that when you're prepared to take a lending out on yourself, the company you have the account with will certainly provide you the quantity of cash you're trying to obtain for a funding.

However the cash will never leave your account, and will remain to produce and gather passion even WHILE your financing is still superior. Example: So, say you have 500K in your account, and you take a funding from it of 500K. You will certainly have 500K in your hand to invest, invest, or do whatever with and at the exact same time you will certainly still have 500K in your account expanding generally in between 57%, without risk.

Clearly they can't give you cash for totally free for no reason. The remarkable component about this is that the cash being held as security remains in your account.

You intend to pay it back every month, because it assists with growth. This is a consistent account so your month-to-month contribution stays the very same. You can boost or lower the amount (but it means it will certainly stay in this way until the following time you transform it). However we do not recommend reducing it unless push involves push and you need to, because it negatively affects the growth of the account.

People really try to increase it since the manner in which substance rate of interest functions: the longer you have the account open, and the more you add, the much better the growthThe firms that we utilize to open up these accounts are commercial firms. To ensure that being said, a couple of points to keep in mind: While you are not utilizing this money in this account, they are.

Infinite Banking Center

This suggests makes it a win win for both partiesAnytime you listen to the word 'funding' there is constantly a rates of interest affiliated with it. Usually talking, usually the finance prices are around 45% however, despite a car loan superior, your money is still expanding in between 57% to make sure that indicates that you're still netting favorable growth, also with a financing outstanding.

And last yet important caution, one of the greatest obstacles to getting going immediately is that you require to have money saved up initially prior to you can take a funding out by yourself money. There are numerous practical benefits and techniques for using infinite banking. You can use a limitless financial car loan to repay things such as a car, pupil loan, home mortgage, etc.

We are permanently actually still expanding cash, as a result of rate of interest that we are still able to collect on our account. Right here is an example of this listed below: Example: Allow's look at a couple of different ways someone might purchase a cars and truck for $50K. Choice 1 You pay $50K cash and you receive the vehicle yet your savings account has 50K much less.

This alternative is even worse than Alternative 1, because although you got the lorry, you lose 7,198.55 greater than if you had actually paid cash. This choice is NOT liked (but one that many individuals take due to the fact that they don't recognize concerning various other options.) Option 3 What if over those 5 years as opposed to repaying the financial institution auto loan, you were putting $833.33 into our account for unlimited banking monthly.

Infinite Income System

Now certainly, the business when you took the funding out charged you a 4.5% interest (generally bc the firm needs to generate income somehow)So you shed $5,929 to the passion. But even after the funding interest is taken, the overall is $60,982 We still made an earnings of $10,982, instead of losing $7198.55 to rate of interest.

At our most recent Sarasota Alternative Investment Club conference Rebekah Samples spoke on the subject of "Exactly how to Become Your Own Financial Institution and Take Advantage Of Your Cash." She spoke briefly concerning the 5Fs: Belief, Family, Physical Fitness, Financial Resource, and Flexibility. She stated these are five points you need to do on your own and you should not outsource them.

Rebekah stated we need to change the method we believe about our economic savings and future. We need to think of our cash similarly we think regarding what we make use of money for. So if you wouldn't buy an automobile and not drive it, why would certainly you take your cost savings and not have it serve to you currently? Why allow financial institutions enjoy the advantages of your savings? She mentioned just how banks offer out the cash you down payment, they make a big revenue, which mosts likely to their investors, and you obtain a little amount of passion.

One way she chatted about was through returns paying entire life insurance coverage strategies, which enables you to utilize cash transferred into them as your own personal bank. Cash earned when the business looking after the insurance policy lends this cash, returns to you as a dividend, and not to the shareholders.

We have actually been taught to think that saving up for something is far better than borrowing cash to buy it. She revealed a graph that showed in both instances, we begin at zero and come to no, whether we borrowed and slowly paid back the financial obligation or we slowly saved up after that utilized the money for the acquisition.

She mentioned the reward of substance passion; this procedure permits you to earn rate of interest on both the first principle and the accumulated rate of interest from previous durations. She claimed dividend paying entire life insurance policy plans permit you to serve as your own bank with tax-free development. These insurance coverage plans allow your cash to substance over time, while offering you the liberty to utilize the principal or the interest when you require it for the things we desire or require in life.

Cash Flow Banking With Life Insurance

Studies show, just concerning 54% of Americans have some kind of life insurance policy protection. This shows that there's a significant void in recognizing the advantages these plans supply beyond simply fatality advantages. The fact is, when done appropriately, utilizing life insurance policy as your personal bank can work.but it doesn't constantly work (a lot more on that later).

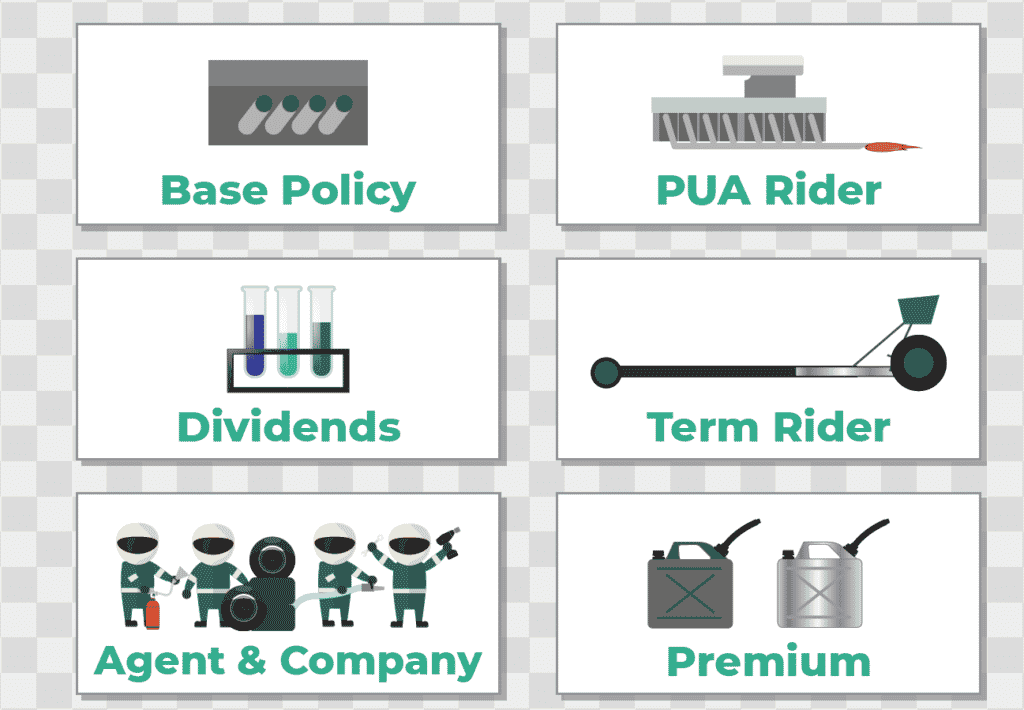

Dive in to discover even more Welcome to the world of, a financial method that enables you to be your very own bank. You can establish up your very own banking system by taking out an entire life insurance coverage policy and paying added costs over and over the basic protection quantity.

Latest Posts

Infinite Bank Statements

Be Your Own Bank - Infinite Growth Plan

Infinite Banking Concept Canada